Turo Profitability Calculator for Existing Hosts

If you’re already on Turo, you might be wondering how much money you’re making. We made a profitability calculator for you too! (If you’re new to Turo, please read THIS Blog Post for new hosts.)

Ready to see how much money you’re actually making? Grab our FREE Turo Profitability Calculator for Existing Hosts and let’s dive in!

A Quick Overview of Accounting (in Simple Terms)

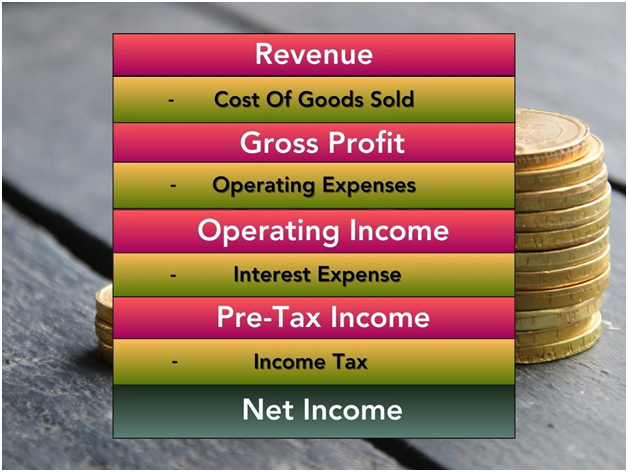

From a high level, let’s cover the basics of financial accounting:

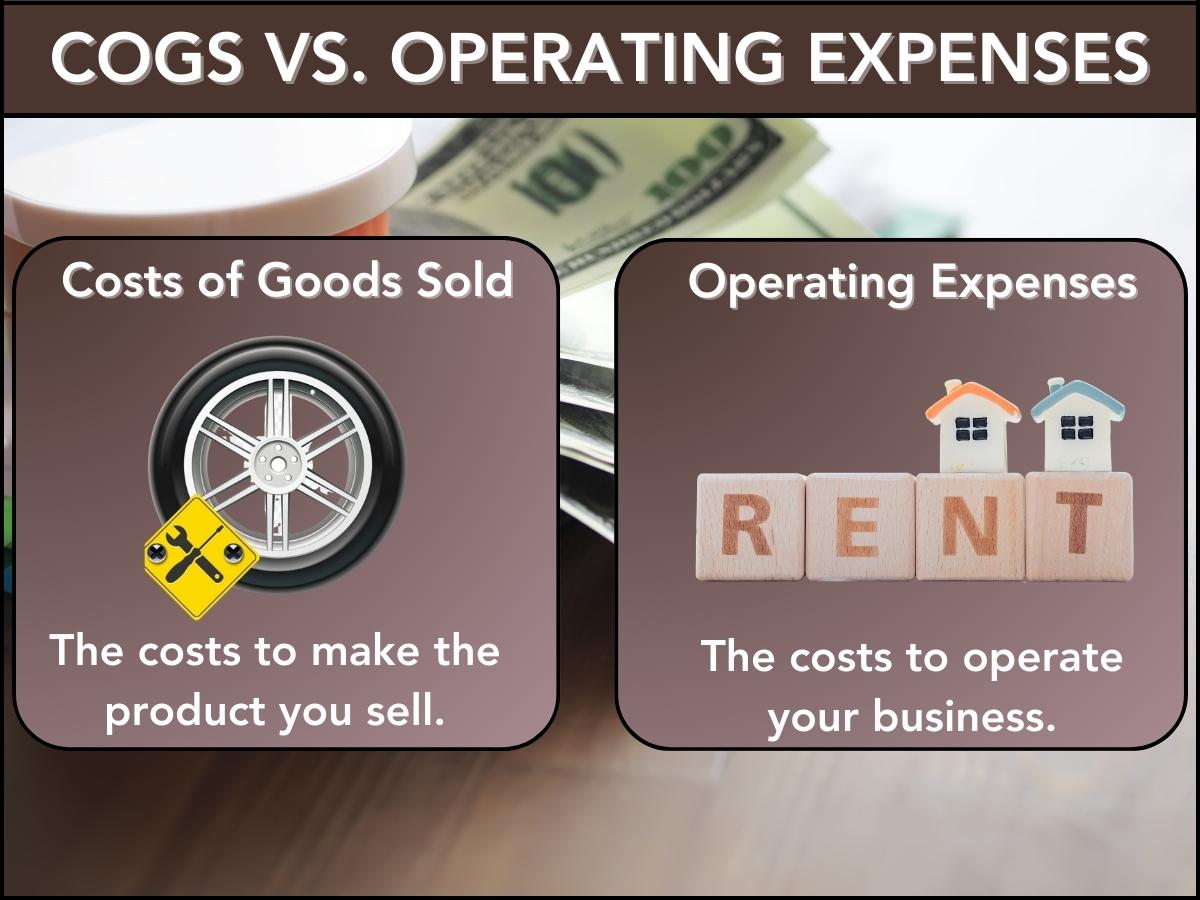

Revenue/Earnings/income – (minus) Costs of Goods Sold = (equals) Gross Profit

The direct costs of renting your vehicle (or Cost of Goods Sold – aka COGS) are things like insurance for your rental car, the car payment, repairs, etc. These are the things absolutely required in order for you to be able to rent your car.

Knowing your Gross Profit is a good way to quickly see if you’re making any money engaging in this or any other type of business.

But you also have other expenses too, right? What about your internet, office rent, office supplies, and other costs you incur but don’t directly go into renting your car? Well, we need to account for those too. These types of expenses are indirect costs, or operating costs.

So, we need to do a little bit more math to see our final income:

Gross Profit (from above) – (minus) Operating Costs = (equals) Operating Income

A positive operating income is another good indicator that your business is profitable. This essentially means that the front end of your business (what you’re selling) has enough margin to also pay for the back end of your business (the operations).

So, we’re done mathing, right?

Not quite.

What about the costs of financing your business (interest), or our dreaded beloved Uncle Sam (taxes)?

So, two more rounds of math:

Operating Income – (minus) Interest = (equals) pre-tax income

Pre-tax Income – (minus) tax expense = NET INCOME

In summary, the math is simple:

Easy peasy? Well, now that we got that out of the way let’s just use our calculator and have it do all the math for us, eh?

Using the Turo Vehicle Profitability Calculator for Existing Hosts

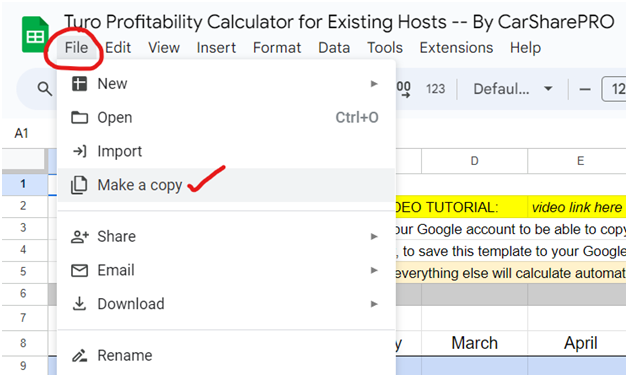

To modify the sheet, you will need to:

- Grab the sheet HERE if you don’t have it yet

- Open the sheet in the browser (make sure you are signed into Google Sheets)

- Click File, Make a Copy. This will save a copy of the template in your Google Sheets and allow you to edit it.

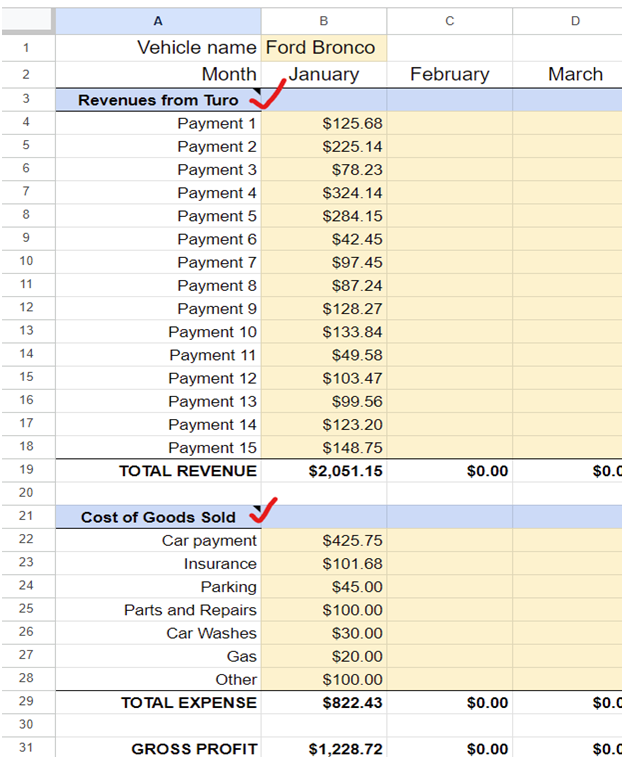

When you first open the Sheet, you will be on the Summary sheet. This sheet summarizes the data from the other 10 tabs. Click on one of the vehicle tabs to see the revenue and direct expense entries for that vehicle.

How To Obtain Your Revenue Data from Turo

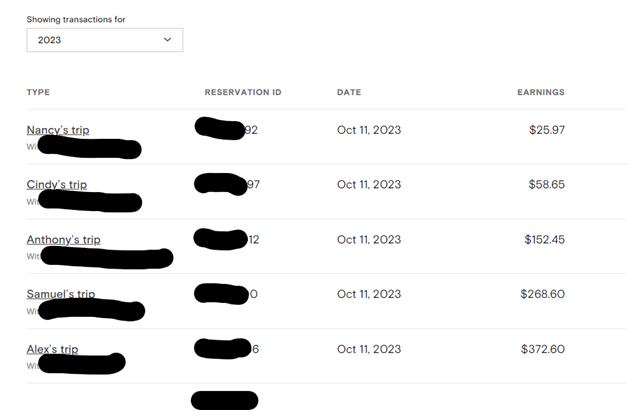

Open your Turo transaction list by signing in to Turo and then clicking this link: https://turo.com/us/en/earnings

It should look like this:

Use this information to enter your earnings into the Calculator in the revenues section where it says, “payment 1”, etc.

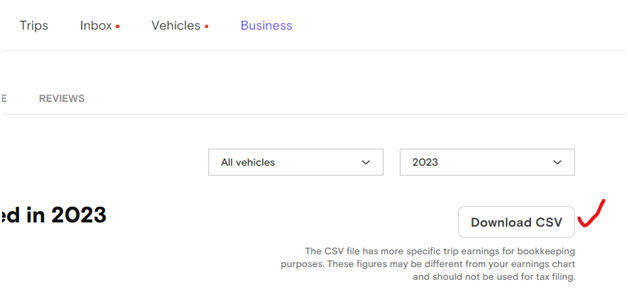

If you are an advanced user and understand how to manipulate CSV files, you can also navigate to https://turo.com/us/en/business/earnings and click “Download CSV” and extract your data. I won’t cover that here, as this is a beginner’s guide.

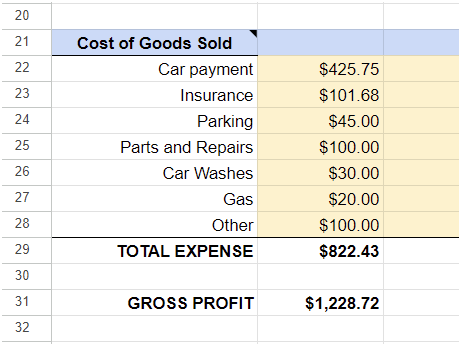

Enter your Cost of Goods Sold (direct vehicle expenses)

Recall, these are the direct costs to renting your vehicle. In our Calculator we entered some of the most common COGS from our experience.

- Car payments amounts can be tricky here. When you file your taxes, your CPA will break out the car payment amount into interest expense and depreciation. But for you, just enter your car payment amount if you are using this car 100% on Turo. If you are using the car only 50% of the time on Turo, enter 50% of your car payment, etc.

- Insurance is the insurance for the vehicle you rent out. Do not include other insurances like your office insurance, your personal vehicle insurance, etc.

- Parking costs here are the costs of parking your vehicle when you drop it off, etc. Do not include general parking costs around you office or anything like that

- Parts and repairs arepretty straightforward, add the costs of parts or repairs here.

- Car washes or detailing are the costs to keep the car in a rentable condition for the next guest.

- Gas costs can go here if they are the cost of doing drop offs. Do not enter the costs of running around or doing errands for your business, we will account for those later as an operating cost.

You should now have your revenues and COGS entered in for this vehicle. Repeat these steps on the remaining tabs for each vehicle you own.

Once you have entered the revenues and COGS for each vehicle, let’s move on to the next step!

Enter the Operating Costs for Your Business

Now that we have entered the COGS for each vehicle, it’s time to look at the operating costs for the entire business.

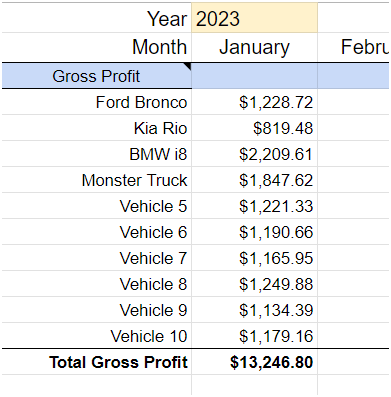

Head back to the Summary tab. In the top section you should see the gross profit for each of your vehicles for the month. This data is imported automatically from the vehicle tabs.

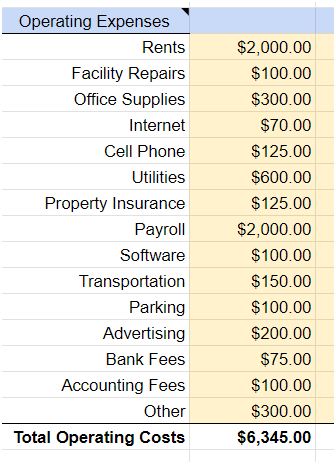

Below the gross profit section, you can see the Operating Expenses. These are the expenses that are required to operate your business but aren’t directly related to any one individual vehicle. As such they are often called indirect costs. Makes sense.

In this section we included the most used types of operating expense categories:

- Rents are the cost of renting your facility for the month.

- Facility Repairs are the costs of upkeep and small improvements on your property (if you do a major remodel, make sure to tell your accountant about that)

- Office Supplies are things like tape, scissors, paper, windshield washer fluid, oils, wrenches, etc. Items you use to run the business.

- Internet is the cost of your office internet, Turo is a web-based platform after all.

- Cell Phone is the cost of your phone and phone plan, again, Turo is web-based and how else are you going to take all those check in pictures?

- Utilities are the cost of your electricity, gas, etc.

- Property Insurance is the cost of insuring your office space.

- Payroll is the cost of you and your employees’ or contractors’ salaries.

- Software is the cost of any software you use for the business, maybe you pay Google for business email, or pay for accounting software. If you subscribed to it and use it for business, it goes here.

- Transportation is the costs of your runaround car/gas, Uber back from the airport, etc.

- Parking is the cost of parking your vehicles when they are NOT on rent, maybe you pay your landlord for extra parking, or pay a parking lot to store your vehicles.

- Advertising or marketing is the cost to spread the word about your business.

- Bank fees are charges from your banking institution, these could also be credit card fees.

- Accounting fees are the fees you pay to your CPA to keep this stuff straight and keep the IRS off your tail.

- Other is a space for any other expenses you might have.

The Calculator will automatically subtract your operating costs from your gross profits and provide you with your total operating income.

One last step!

Enter Your Interest Expense and Tax Rate

This is the last step.

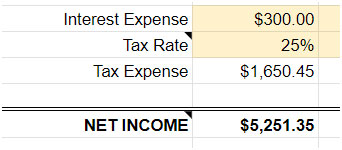

Now that you have your operating income the last two items are interest and tax expenses.

- Interest Expense is the cost of any loans or other money you borrowed for your business, like a small business loan (this is NOT the car interest from the COGS section). If you do not know your interest expenses, then leave this blank and your CPA will calculate it for you at the end of the year.

- Tax Expense is the cost of your taxes. For this you can enter your tax rate if you know it, if you don’t know it then 25% is generally considered a good estimate.

You’re DONE! You can now see your ACTUAL NET INCOME after all expenses!

Treat Your Turo Business Like an Actual Business

The most successful Turo hosts are those who treat their Turo business like an actual business, and that starts by knowing your actual numbers. Once you know the numbers you can analyze how to make more money or where to cut costs, and you will not be surprised by your CPA at the end of the year.